Role of fiscal policy measures in solving the unemployment crisis of India

The problem of unemployment is not only a contemporary macroeconomic issue, but it is something that has been weighing down the Indian economy for many decades now. In this paper, I have put forward my thoughts on how this problem can be tackled with the help of an expansionary fiscal policy as suggested by Keynes, and how these changes would affect the IS-LM model with respect to the Indian economy.

Effective fiscal policy measures to reduce unemployment

A stimulated increase in the aggregate demand and therefore the rate of economic growth in the economy with the help of fiscal policies can help the government reduce the rate of unemployment by a significant margin, in order to achieve this the Government must cut down on the taxes (T) and increase the government spending (G), or in other words the government should pursue expansionary fiscal policy measures. Lowering the taxes would increase the disposable income of every economic agent and therefore this would result in an increase in consumption from their side thereby increasing the aggregate demand. This increase in aggregate demand would cause an increase in the real GDP of the economy and as the firms and companies increase their output, they will start seeking for more labour, thus increasing the labour demand and encouraging more economic growth.

Now, we know that Y (GDP) = C + I + G + Xn, but increasing the government spending

simply to match with the GDP (that is, to equate the both sides of the equation) would not

work well in the real economy because of the multiplier effect. Multiplier effect states

that even a small increase in the government spending would result in a much larger

change in the GDP, and this takes place as every individual who benefitted from the

increase in Government spending and in the initial increase in GDP starts spending

more and more in the economy.

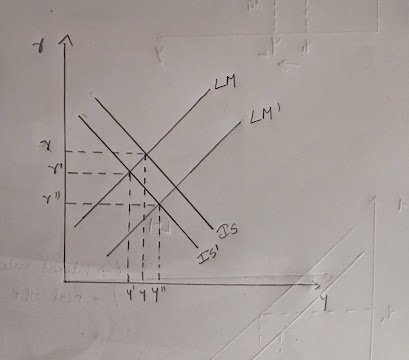

Unemployment in the Indian economy and the IS-LM framework

To resolve this problem if the government spending is decreased, then the aggregate demand in the economy would decrease and thus the output would also decrease, thereby shifting the IS curve to the left.

References

SUNDARAM, J., & CHOWDHURY, A. (2013). Reducing Unemployment in the Face of Growing Public Debt. Economic and Political Weekly. Retrieved August 2, 2020.

Sudhir J. Mulji. (2003). Agriculture and Unemployment. Economic and Political Weekly, 38(15), 1463-1466. Retrieved August 2, 2020, from www.jstor.org/stable/44134280

EPW Research Foundation. (2000). Need for Expansionary Fiscal and Monetary Policies. Economic and Political Weekly, 35(8/9), 594-600. Retrieved August 2, 2020, from www.jstor.org/stable/4408950

Caldentey, E. (2003). Chicago, Keynes and Fiscal Policy. Investigación Económica, Retrieved August 2, 2020.

(n.d.). Retrieved 2020-08-02. Retrieved August 2, 2020, Source : World Bank

Lucas, R. (1978). Unemployment Policy. The American Economic Review, 68(2), 353-357. Retrieved August 2, 2020, from www.jstor.org/stable/1816720

Aschauer, D. (1985). Fiscal Policy and Aggregate Demand. The American Economic Review.

Interesting perspective, great work.

ReplyDeleteBlog was really informative 💯

ReplyDeleteVery accurate and informative. Simplified the concepts for easier understanding!

ReplyDeleteVery well researched work with proper facts and figures. Well Done!!

ReplyDeleteWow, great work.

ReplyDeleteDetailed and well supported by facts . Worth the read

ReplyDeleteVery informative!

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteVery well written in simplified language for easy understanding!

ReplyDeleteThis is one of a kind. Really super and outstanding.

ReplyDeleteGreat Analysis. Keep up your work!

ReplyDeleteGreat observation and a very crisp presentation. You got a great future ahead of you!

ReplyDeleteGreat work, this was really informative!

ReplyDeleteVery informative!

ReplyDeleteSterling and exquisitive work. Delighted to see my school day pal advancing to greater heights.

ReplyDeleteAlways be exceptional and noteworthy as u r right now

Excellent work! It was a delight to read

ReplyDeleteVery informative

ReplyDelete